Today I am doing a takeover on the Instastories for Frolo, the single parenting community app, so thought I might share this post from earlier in 2020 about what I did about my money when my marriage suddenly – and surprisingly – ended.

Check it out…

Last month, my life was flipped upside down when my husband and I separated.

I won’t get into the details of what happened, but will say that it came as quite a shock and he moved out just days before Christmas.

We’ve decided to try our best to be amicable and have agreed to coparent our six-year-old daughter because, while we may have split up, our family has not.

So the last four weeks has seen us trying to navigate how that works while staying friendly as possible for Audrey’s sake.

*deep breath and false smiles at the ready*

Luckily, I survived Christmas, and the new decade kicked off with us tackling how to “consciously uncouple” our finances.

I was quite surprised to find that despite there being page after page of information on how to pay for your wedding, there seems to be limited advice on how sort out your finances if that marriage comes to an end.

Sure, you can find lots out about what to ask for in a divorce settlement, but what are you supposed to do in the immediate days and months following the spilt?

What can you do to soften the blow of your separation?

Things have been rather upside down here at home the last month, but I feel like I’m finally getting my head straight.

After 15 years together, do I even remember how to live on my own?

How will I pay all the bills while being the main provider of childcare for our daughter?

Fortunately, my ex-husband (I’m still not used to calling him that) wants to contribute to the household bills but my previous budget was based on two incomes, and now that the majority of his gone, how am I going to make sure everything is paid?

It seems that I am not the only one who worries when they find themselves in my position – figures from Fidelity International’s Women and Money campaign show that a third of women in relationships would not feel financially stable in the event of a marriage breakdown.

And who can blame us? Women are more likely to earn less, take career breaks to look after loved ones or work part-time which can leave them with fewer savings than their spouse.

Let’s be honest, it’s not a recipe for financial independence – especially as your role post break up is going to consist of you having to work more, while still being the “free childminder” that you have been for the last number of years.

Add to this that you have to navigate the emotional upset of a relationship break-up and it can be hard to find the headspace to deal with money too.

I totally get it: that’s been me for the last month.

But now that I’m through the worst of the shock, I’ve realised that as I’m the only one bringing in the money – and paying down those bills – I need to be sure that I’m making the most of what I have more than ever.

So, when my pal Lucy offered to take Audrey for me last week, I sat down in my office and sorted my shit out.

After weeks of being in a situation that was very much out of my control, for the first time I felt back in the driver’s seat – and it was ever so comforting.

I’m not going to lie, looking so closely at my budget was scary – and an eyeopener even for a bargain hunter like me – but it was so satisfying.

So, while I can’t tell you how to get through a broken heart, I can at least help you get a handle on your cash.

Here is what I’ve done so far – and what you can do too.

I’ve also included some financial safeguarding suggestions for those who are not in an amicable position such as mine. But, even if you think things are very reasonable, if you have any doubts, always err on the side of caution.

The Future is Female – the new motto in our “girls’ house”

USE THE EMMA APP

In November, I downloaded Emma, the money management app – and it has been even handier since my circumstances at home have changed.

This app uses open banking to combine information from all of your bank accounts, savings accounts, credit cards and investments and analyses your spending.

My first analysis highlighted some serious spending I had overlooked. I explain what happened over on Instagram.

Once the shock wore off, I started logging in regularly to monitor my spending – and it has definitely been handy when looking at my budget once my circumstances at home changed.

The way that the app organises transactions was very useful for quick referencing when doing your sums post break up – and totally helped me focus on what I have been spending.

Go on, give it a try. You’ll be surprised what you discover.

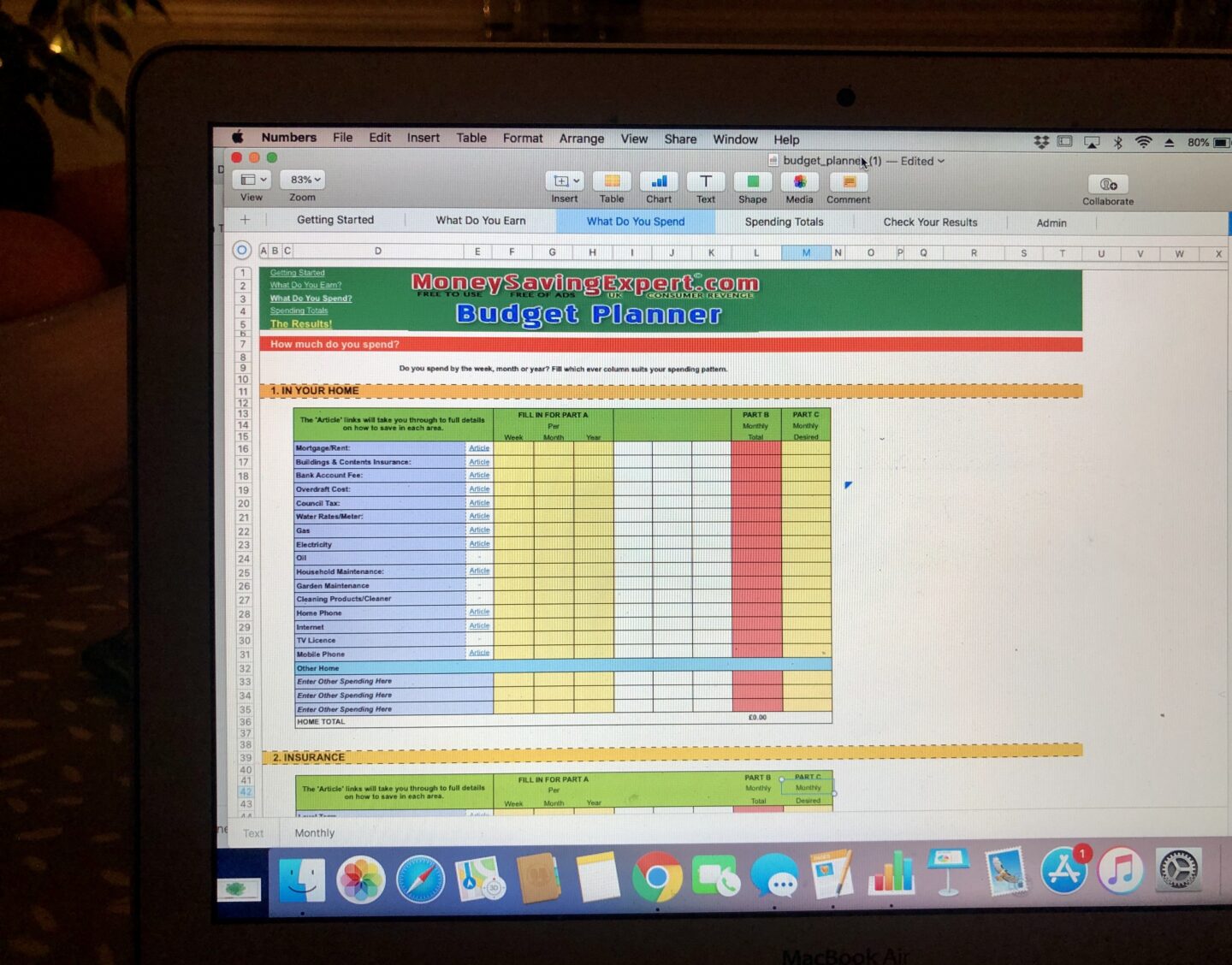

CREATE A BUDGET

After my husband left, I was forced to deal with the brutal reality that we would have to fund two homes on what was once our joint income.

If, like me, you are staying in the house you may start to panic about suddenly having this financial responsibility fall on your shoulders.

Paying for your house is more than just a mortgage payment – there’s council tax, energy bills, home insurance and general maintenance to consider too.

If your ex-partner agrees to pay more than typical child maintenance, then you need to know how much you need to a roof over your head and food on the table for you and the kids.

This can be calculated here though, if you ask me, it is far too little to keep women – who typically remain the full-time childcare providers – from falling into a debt spiral.

Luckily, my ex has been very cooperative and is paying more than that – I don’t know what I would do if he wasn’t, but nevertheless, I needed a plan,

So, I set out to create a budget.

To do this, I used Moneysavingexpert’s free downloadable spreadsheet which allows to detail all your income and outgoings.

This is one of the most useful online tools I have used to date – I honestly can’t recommend it enough.

Here you enter all your expenses, whether they are weekly, monthly or annually and the clever spreadsheet does all the sums for you.

What’s more, it is a great time to have a look at any bills that you might be able to reduce.

I managed to reduce my home security bill by £17 a month after a quick call to ADT – this meant I saved £200 in minutes. Boom.

Once you know where your money is coming from, how much there is and where it is all going, you will be able have a proper negotiation with your ex.

It’s hard for them to argue with an accurate spreadsheet.

I like to think of it as a bargaining tool – and suspect that having it all in black and white will really pay dividends.

Try it. I promise that you’ll be impressed.

This is one of the most useful online tools I have used to date – I honestly can’t recommend it enough. Try it. I promise that you’ll be impressed.

CUT THE COST OF YOUR COUNCIL TAX

Make sure that you are not paying more than you need to on your council tax bill.

These unavoidable bills are calculated on the assumption that two adults live at a property, so if you’re the only adult in your household you’ll get 25% off your Council Tax bill.

I made sure to have the discount backdated to the day that he moved out – and it means my monthly repayments well by £40 a month – or £480 a year, so definitely worth having.

To apply for a reduction from your local council, visit www.gov.uk/apply-for-council-tax-discount.

GET THE SUPPORT YOU NEED

Separating from a partner can have a big impact on your finances, especially if you relied on their income during your relationship.

If your marriage or civil partnership ends, you can ask for financial support – known as ‘spousal maintenance’ – from your ex-partner as soon as you separate. This is in addition to any child maintenance they might have to pay.

If you weren’t married or in a civil partnership, you’ll have to share the costs of looking after any children you have together – but you don’t have to support each other financially when you separate.

You don’t have to go to court to arrange financial support. If possible, it’s cheaper and easier to come to an agreement between yourselves – this is known as a ‘voluntary arrangement’.

If you’re struggling to work out maintenance payments by yourselves, you might be able to reach an agreement through mediation.

Mediation starts with a ‘mediation information and assessment meeting’ (MIAM). At the MIAM you’ll find out what mediation is and how it can help you. You can find out more about mediation before you go to the MIAM.

If you have a voluntary arrangement and you’re struggling with the maintenance you get from your ex-partner, you could try talking to them and explaining why you need more money.

ARE YOU ELIGIBLE FOR BENEFITS?

Many government-backed benefits are based not only on your individual wage, but also on total household income.

So if you live alone, this could mean that you are eligible for assistance unbeknownst to you.

This is especially important if you have children as there are a number of tax breaks and benefits which are in place to help single parents meet the cost of childcare.

For this reason it’s definitely worth double checking your eligibility for benefits even if you don’t think you’d be entitled to receive anything.

To see if you are missing out, visit Moneysavingexpert.com’s handy benefits checker, which claims you need just ten minutes to complete.

I didn’t have much luck in this department, but it’s good to know one way or another.

When your relationship ends, finding your new normal can be a challenge – especially when it comes to cash

WHEN THE “WE” BECOMES THE “ME”

If you and your partner are splitting up, it’s likely that you’ll have some joint finances, such as bank accounts or loans, to sort out.

You may also have taken out insurance policies and have bills in both your names that you will need to cancel or transfer.

If the relationship breakdown was not amicable, it’s a good idea to contact your bank or loan provider to explain what has happened.

With any joint loan such as a mortgage or overdraft, you are each liable for the entire debt.

If you don’t keep up the joint payments up not only could you lose your home, but it could damage your credit rating, which could make it harder for both of you to borrow in the future. More about this below.

If you have a credit card account and there’s a second card for your ex-partner, you will be responsible for paying for their spending as well as yours.

You could ask your bank to change the way the account is set up so that both of you have to agree to any money being withdrawn, or to freeze it.

Though bear in mind that if you freeze the account, both of you have to agree to ‘unfreeze’ it. This might be a problem if your ex-partner doesn’t want to co-operate – so tread carefully.

Similarly, make sure you stop any wage payments going into your joint account if you’re worried that your ex-partner won’t agree to you taking out this money.

When it comes to any savings, hopefully you’ll be able to agree how you will divide any that you have built up together.

Cash in a joint savings account belongs equally to two spouses or civil partners, otherwise it belongs to the person who originally paid it in.

Someone who hasn’t made a contribution to a joint account could make a claim for a share of it, but it can be difficult to prove entitlement.

WHAT ABOUT YOUR INSURANCE?

If you have a home insurance policy in both your names and, for example, your ex-partner is moving out, you might have to ask them to confirm that they are happy for their name to come off the policy.

Similarly, if they are a named driver on your car insurance, you might ask to have them removed if they won’t be driving your car in the future.

Bear in mind that single drivers are often charged more than those with a spouse – figures show that single men and women pay more for car insurance than their married counterparts – often around £100 a year more according to ComparetheMarket.com.

Married couples are considered less likely to claim because studies show that single drivers are at twice the risk of having an accident behind the wheel compared to people who are living in matrimonial bliss. Awesome.

Interestingly, when I contacted Esure to have my ex taken off my policy, it would have actually cost me £35 thanks to an administration charge, and my premiums wouldn’t fall by having his name removed.

Needless to say, I left him on the policy as it will come in handy to have him able to drive my car should there be an emergency.

Single drivers are often charged more than those with a spouse. Awesome.

CONSIDER YOUR CREDIT REPORT

Share a bank account with someone?

Then you are you are more connected than you may think as lenders will often look at both of your credit reports when assessing your credit worthiness.

This can be bad news if you are splitting from someone that you don’t trust or is bad with money.

By opening a joint account, not only are you granting the other person access to your cash, but the credit record of the other account holder will have an impact on your own score.

This is because your names will appear on each of your reports under the section marked ‘financial associates’.

This means that you will be ‘co-scored’ by the three main credit reference agencies – Experian, Equifax and CallCredit.

So should you want to apply for credit in your own name, even though your ‘associate’ hasn’t applied too, the lender will see their name on your report and consider the information on their credit report – and could have a negative impact on you.

If you have had a joint account with someone who you are concerned about, don’t panic. There are steps that you can take to break the financial link between you. This is known as a “financial disassociation”.

All you need do is ensure that the accounts in question are completely closed – and any debts paid – then request the credit agencies to have them removed from your credit report.

PROTECT YOURSELF

If you are in anyway worried about your ex having access to your credit, there’s a new service that promises to stop people from taking out loans, credit cards and other financial products in your name.

Those who sign up to the free Vulnerability Registration Service can ensure applications made in their name are automatically declined.

Alternatively, those who think they might apply for credit in future can set-up a referral flag, which means they have to give verbal consent before any applications can be approved.

There is no cost to register and your preference and details will be held for at least three months, after which users can ask to have their information removed if they feel they are no longer at risk. Boom.

Follow me on social media

Thank you so much for this helpful information.

It is a very well written blog, I wish you all the best ?

Nice blog ! Thank you for provide such a nice information

Big love to you x

I’ve written about the financial side of splitting up here: https://debtcamel.co.uk/splitting-up-finances/.

My strong advice is to separate as fast as possible1